Get the free maryland form 4a

Show details

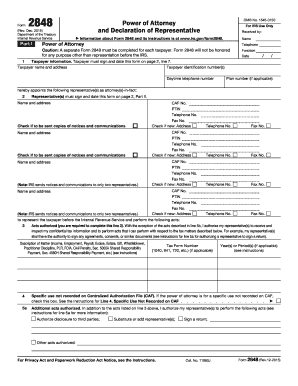

STATE OF MARYLAND DEPARTMENT OF ASSESSMENTS AND TAXATION PERSONAL PROPERTY DIVISION FORM 4A Balance Sheet Form 4A Name of Business Department ID Number Enter dollar amounts without commas. ASSETS CURRENT ASSETS 1. Cash Beginning of Period month WITHIN MARYLAND day year TOTAL End of Period 2. Marketable Securities 3. Accounts Receivable 4. Inventory 5. Other Current Assets PROPERTY PLANT AND EQUIPMENT 6. Land 7. Buildings 8. Leasehold Improvements 9. Equipment 10. SUBTOTAL Property Plant and...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your maryland form 4a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maryland form 4a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing maryland form 4a online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit maryland form 4a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out maryland form 4a

How to fill out Maryland Form 4A:

01

The first step in filling out Maryland Form 4A is to gather all the necessary information and documents. This includes the taxpayer's personal information, such as their full name, Social Security number, address, and phone number.

02

Next, review the purpose of the form and ensure that you are eligible to use it. Maryland Form 4A is used to claim exemptions and deductions for residents of Maryland who are eligible for certain tax benefits, such as the Personal Exemption and the Homeowner's Property Tax Credit.

03

Once you have verified your eligibility, start with the top section of the form, which requires you to provide your basic personal information, such as your name and SSN. Make sure to double-check the accuracy of the information you provide.

04

Move on to the next section, which pertains to the Personal Exemption Credit. This section requires you to provide details about yourself and your dependents if applicable. You will be asked to enter the names, SSNs, and relationships of all individuals you are claiming as dependents for tax purposes.

05

The next section is the Homeowner's Property Tax Credit section, which is optional. If you own a home in Maryland, you may be eligible for this credit. Provide the necessary information, such as your homeowner information, taxable year, and the property address.

06

After completing the Homeowner's Property Tax Credit section, continue to the final section of the form, which requires your signature and date. Make sure to review the entire form for accuracy before signing and dating it.

Who needs Maryland Form 4A?

01

Maryland Form 4A is specifically designed for residents of Maryland who are eligible for certain tax benefits, such as the Personal Exemption Credit and the Homeowner's Property Tax Credit. Those who wish to claim these exemptions and deductions should complete and submit this form.

02

Individuals who have dependents and want to claim them for tax purposes will also need to fill out Maryland Form 4A. This form allows taxpayers to provide the necessary information about their dependents, such as their names, SSNs, and relationships.

03

Homeowners in Maryland who are eligible for the Homeowner's Property Tax Credit will also need to complete this form. This credit provides financial relief to homeowners by reducing their property tax liability.

In summary, Maryland Form 4A is necessary for residents of Maryland who want to claim exemptions and deductions on their state taxes, specifically the Personal Exemption Credit and the Homeowner's Property Tax Credit. Those with dependents and homeowners are the primary individuals who need this form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is maryland form 4a?

Maryland Form 4A is a state tax form used to report and pay state withholding taxes.

Who is required to file maryland form 4a?

Employers in Maryland are required to file Form 4A to report state withholding taxes.

How to fill out maryland form 4a?

Maryland Form 4A can be filled out manually or electronically. Employers need to provide information about their business, employees, and withholding amounts.

What is the purpose of maryland form 4a?

The purpose of Maryland Form 4A is to report and remit state withholding taxes to the Maryland Department of Revenue.

What information must be reported on maryland form 4a?

Information such as employer identification number, employee wages, withholding amounts, and total tax liability must be reported on Maryland Form 4A.

When is the deadline to file maryland form 4a in 2023?

The deadline to file Maryland Form 4A in 2023 is January 31st.

What is the penalty for the late filing of maryland form 4a?

The penalty for late filing of Maryland Form 4A is a percentage of the tax liability, based on the number of days the return is late.

How do I execute maryland form 4a online?

Completing and signing maryland form 4a online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out maryland form 4a using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign maryland form 4a and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How can I fill out maryland form 4a on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your maryland form 4a from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your maryland form 4a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.